Play Your Cards Right

Travel is supposed to be relaxing. Kim and I want a travel credit card that would help make that happen.

We don't want to worry about fees, foreign exchange fees, or convoluted points schemes. All we want is a single travel credit card we can whip out use without thinking.

Simple…

Or maybe not.

The Canadian credit card companies do their best to complicate things as much as possible so you make decisions they benefit from. So we had to do some digging to understand what to look out for and what best met our needs.

And we found it. Our international travel credit card does everything we need and keeps hundreds of dollars in our pockets. It's so handy Kim even included it among her 15 favorite travel essentials.

Here's what we found and how to find the best credit card for international travel for you.

In This Guide to Canadian Credit Cards for International Travel…

What to Look For in the Credit Cards for International Travel

✔ Zero Foreign Exchange Fees

Just about every Canadian credit card charges a 2.5% fee for all foreign currency transactions. Using them internationally is like walking around with holes in your pockets. Money steadily trickles out of them and you might not even notice.

If you pay for a 200 Euro hotel room in France, you'll be charged an extra 5 euros. Or if you buy a pair of shoes from Nike.com for 100 US dollars, your card will charge you an extra $2.50 US.

This 2.5% adds up.

But it's small enough that credit card companies try to hide it. They're baked into the total transaction cost so you don't even see that hole in your pocket that they're feeding off.

Don't let them get away with it. Sew up the hole in your pocket with a travel credit card that doesn't have this 2.5% foreign transaction fee.

✔ Cash Back on Travel Expenses

The yin to the 2.5% foreign exchange fee's yang is cash back.

Cash back is the percent reward credit cards pay you for every transaction you make with it. The more cash back, the better. You can get as much as 3% with the right travel credit card.

We're talking about pure cash, not points. As we said before, we're not interested in the travel hacking points game. To us, a buck in the hand is worth two theoretical bucks worth of points in the bush.

✔ Free Travel Medical Insurance

The best credit cards for international travel give you free travel insurance.

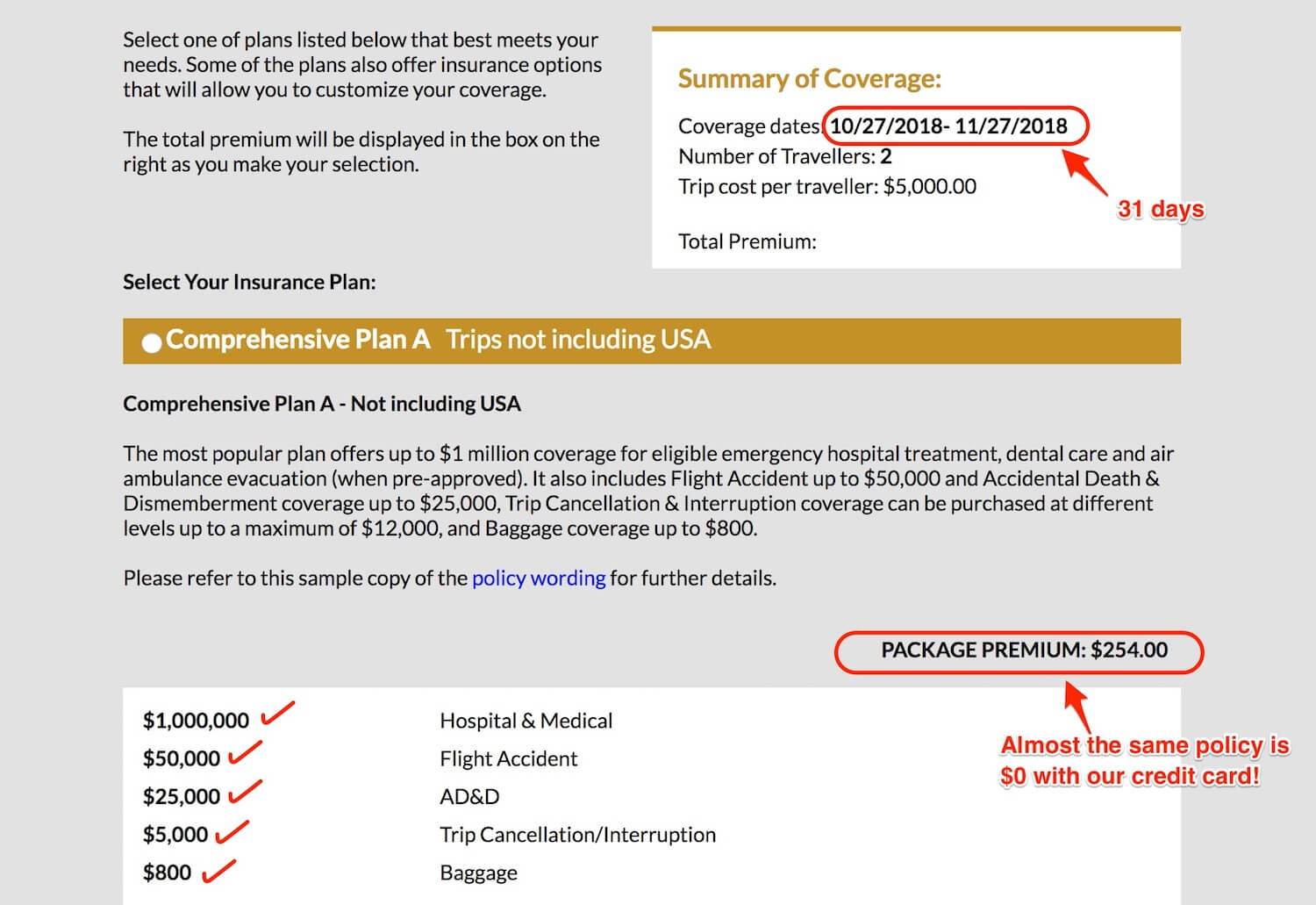

Ours, for example, gives us 31 days. As you can see in the screenshot above, those 31 days of travel insurance would cost $254 dollars if we bought it on our own.

If you typically go away for a week or two, a card with that provides fewer days insurance would be fine. Just double check if the card limits the number of trips you can take a year.

And, whatever the case, get insured. I didn't think it was necessary until I did my research on how to find the best travel insurance and realized how naive I'd been.

Warning: Your credit card will only provide travel insurance if you use it for 75% to 100% (depending on the card) of "Eligible Expenses" like transportation, hotels, and packaged tours.

✔ Free Car Rental Insurance

If you plan on renting a car while traveling abroad, complementary insurance provided by your credit card is an added bonus.

Note that the insurance offered by credit cards only covers damage to the vehicle you rent, minus tires and windshields. It doesn't cover damage to you, your passengers, and whatever you smash into (or smashes into you). Most rental car companies cover this third-party damage, but definitely double check before taking a car off the lot.

To be covered by your credit card's insurance, you have to use the card for the reservation, payment, and payment guarantee, and decline the rental car company's Collision Damage Waiver and/or Loss Damage Waiver Coverage.

This post from Nerd Wallet has more details on what to look out for when renting a car and relying on your credit card's insurance.

The Best International Travel Credit Cards on the Market

There is no absolute best Canadian credit card for international travel.

Your choice depends on your income level and how long you typically travel for. It doesn't depend, though, on the bank you use. For example, you can get the Scotiabank card even if you bank with CIBC (though you might get a discount if you bank with Scotiabank.)

Here's what we found are the best credit cards to choose from:

Best Card for 10-Day-or-More Travelers:

Scotiabank Passport Visa Infinite

What You Get:

- Annual Fee: $139 ($69 if you have a Scotia Total Equity Plan account),

- Supplementary Card: $0 for 1st one, then $50

- Net Cash Back: 2% on most travel-related spending

- Foreign Transaction Fees: 0%

- Cash Back: 2% on groceries, dining, entertainment, and transit. 1% on everything else.

- Travel Medical Insurance: 25 days (10 if aged 65+)

- Baggage Insurance: $1,000 per trip

- Trip Cancellation and Interruption: $2,500 pp, $10,000 per trip

- Car Rental: 48 days up to $65,000

- Extra Perks:

- 6 Priority Pass airport lounge passes a year

- Minimum Income Requirement: $60,000 individual, $100,000 household

Our Verdict:

If we didn't get a discount on the HSBC World Elite for having an account with them, this is the card we would have gotten.

The $139 annual fee for the Scotiabank Passport Visa Infinite card is your best bet if you meet any one or more of these criteria:

- Typically travel for more than 10 days at a time because its insurance covers you for 25 days, 15 more than the zero-fee Rogers World Elite.

- Make more than $60k a year but less than $80k, which is the minimum for the Rogers card.

- Are willing to spend extra to be able to hang out in airport lounges. The card comes with six annual free passes.

Be Careful

I've noticed most other sites that are rating and reviewing these no foreign exchange fee credit cards pimp this Scotiabank one pretty hard.

You wanna know why?

Because it pays the highest commission.

Don't get me wrong, it is a good card, but don't fall for their over-the-top selling tactics either.

Skip the Scotiabank Gold American Express Card

Scotiabank's new foreign transaction fee-free card costs about the same as the Passport Visa Infinite ($120), gives you 25 days of insurance, and promotes high rewards points. Read the fine print, though, and you'll see you only get those points on transactions in Canadian dollars. You're better off with the Visa Infinite.

Best Card for Us and Travelers Like Us:

The HSBC Premier World Elite Credit Card

What You Get:

- Annual Fee: $149 annual fee ($99 for HSBC account holders)

- Additional Card: $0

- Net Cash Back: 1.5% on most

- Foreign Transaction Fees: 0%

- Cash Back: 3% on flights, hotels, car rentals, tours; 1.5% on all else

- Travel Medical Insurance: 31 days

- Trip Cancellation and Interruption: $2,000 per person, $5,000 per trip

- Baggage Insurance: $750 per person, $200 for necessities if bags delayed 12 hours or more

- Car Rental: Up to 31 days per rental, $2,000 theft of personal effects, $65,000 max car value

- Extra Perks:

- $100 per year of travel enhancement credit to pay for seat upgrades, baggage fees, or airport lounge passes

- Global Boingo wireless access for up to 4 devices

- Minimum Income Requirement: $80,000 individual income, $150,000 household income, or $400,000 assets under management in Canada

Our Verdict:

The HSBC Premier World Elite Credit Card is neck-and-neck with the Scotiabank card for best Canadian credit card for international travel.

The downsides compared to the Scotiabank card are that it costs $10 more per year, doesn't include lounge passes, and only offers 1.5% (vs 2%) on groceries, dining, entertainment.

The benefits compared to the Scotiabank card are 6 days longer medical insurance (31 vs. 25), a $100 travel enhancement credit, and higher cash back (3% vs 1%) on flights, hotels, car rentals, and tours.

We chose this card because I get a discount for having an HSBC account, the first year is free, the $100 travel enhancement is more valuable to Kim and me than the lounge passes, and the extra travel insurance saves us some money because we travel for more than a month at at time.

Best Zero-Fee Card (If You Make More than $80k a Year):

Rogers World Elite Mastercard

What You Get:

- Annual Fee: $0

- Net Cash Back: 1.5%

- Foreign Transaction Fees: 2.5%

- Cash Back: 4% on purchases in foreign currency, 1.75% in purchases in Canadian dollars

- Travel Medical Insurance: 10 days. This card covers you even if you don't charge your travel expenses to it.

- Baggage Insurance: $0

- Trip Cancellation and Interruption: $1,000 per person, $5,000 per account

- Car Rental: Up to 31 days per rental, $0 theft of personal effects, $65,000 max car value

- Little Perks: Nothing worth mentioning

- Minimum Income Requirement: $80,000 annual personal or $150,000 annual household

Our Verdict:

With the Rogers World Elite you get a pretty sweet 1.5% cash back on foreign currency purchases and 10 days travel insurance for free.

The downsides are you have to make $80,000 or more a year and the cash back is not automatic. You also have to call Rogers in December to request a statement credit.

Best Zero-Fee Card (If You Make Less than $80k a Year):

Home Trust Preferred Visa

What You Get:

- Net Cash Back: 1%

- Foreign Transaction Fees: 0%

- Cash Back: 1%. Maximum 10 transactions a day.

- Travel Medical Insurance: None

- Baggage Insurance: None

- Trip Cancellation and Interruption: None

- Car Rental: 48 days, $65,000 max, and roadside assistance in North America

- Little Perks: None

- Annual Fee: $0

- Minimum Income Requirement: None

Our Verdict:

The Home Trust Preferred Visa gives you 1% cash back and zero foreign exchange frees and that's it.

But it doesn't take much from you either because it's free. It also doesn't have the minimum income requirement that the Rogers World Elite card does.

The big downside of this card is the lack of travel insurance.

To get free insurance elsewhere, check if your bank account credit card comes with some insurance. If so, you could buy your flight with it, then use the Home Trust card while traveling to save on foreign exchange fees.

Best Credit Cards to Keep an Eye On:

Brim Financial Standard / World / World Elite Mastercard

What You Get:

- Annual Fee: $0 /$99 / $199

- Net Cash Back: 1% / 1.5% / 2%

- Foreign Transaction Fees: 0%

- Cash Back: 1% / 1.5% / 2%

- Travel Medical Insurance: 0 / 8 days, $5,000,000, <65 years old / 15 days, $5,000,000 (3 days if >65)

- Baggage Insurance: 0 / $1,000 pp, $2,000 max / $1,000 pp, $2,000 max

- Trip Cancellation and Interruption: 0 / 0 / $2,000 pp up to $5,000 cancellation; $5,000 pp up to $25,000 interruption

- Car Rental: 0 / 48 days, $65,000 max / 48 days, $85,000 max

- Little Perks:

- Free Boingo WiFi

- Mobile device insurance $500 / $1,000 / $1,000

- Additional Cards: $0 / $20 / $50

- Minimum Income Requirement: 0 / uncertain / $80,000 individual

Our Verdict:

Brim's cards are new on the scene, for better or for worse.

Since launching earlier this year with some fanfare, big promises, and a flashy website, there have been a lot of hiccups and online complaints (see the more than 6,000 comments on this RedFlag forum). It took them forever to deliver the cards to the people who applied, and the jury's out on whether they will ever deliver on what they promise.

One huge concern relates to Brim's claims to have zero foreign transaction fees. Instead of using Mastercard's exchange rates, they've decided to use their own, so it's unclear whether they might actually take a cut of their own.

The free card is essentially the same as the Home Trust one, minus car insurance plus free Boingo WiFi and $500 mobile phone insurance.

The $99 card is probably only worth considering if you make less than $80,000 a year. Otherwise, you can get about the same benefits for free with the Rogers World Elite. That, or pay $40 more a year and get the Scotiabank card with better cash back, better insurance, and the six free airport lounge passes.

And the $199 card has the most generous cash back rewards of all the foreign exchange free credit cards we've found, but it's still probably not worth it compared to the cheaper Scotiabank and HSBC cards.

Given the uncertainty around Brim, I'd recommend waiting to see whether they can deliver on their promises (and deliver their cards to applicants).

Best Not to Get These Cards:

Rogers Platinum Mastercard and Fido Mastercard

What You Get:

- Net Cash Back: 0.5%

- Foreign Transaction Fees: 2.5%

- Cash Back: 3%

- Travel Medical Insurance: None

- Baggage Insurance: None

- Trip Cancellation and Interruption: None

- Car Rental: None

- Little Perks: None

- Annual Fee: $0

- Minimum Income Requirement: None

Our Verdict:

There's really no reason to get these credit cards for your international travels because they give you less cash back than the Brim and Home Trust alternatives and don't offer anything the others don't.

Any recommendations for Canadian debit cards with no transaction/exchange fees?

Thanks for this super helpful guide, by the way 🙂

Good question, Taylor. I haven't looked into it because I'm lucky to have a US debit card with zero fees. Check out Revolut. They're huge in Europe and recently launched in Canada. There's a waitlist, but I got an account and didn't apply too long ago. Otherwise, check out GetStack.ca.

Try stack no foreign fees

However Capital One secured M/C doesn’t have them either and you build credit

I've had a really good experience with both Tangerine (Scotiabank) and Simplii Financial (CIBC). They have very little to non-existent fees. You should check them out. I think they both have a promo going on where you can get up to $200 for signing up and following their conditions.

Plus with both, you get 1 free 50 page cheque book.

Hi, good article all around. I was looking into Brim and home trust which is what brought me here.

One comment I have, Brim's website says that they use the mastercard exchange rate with no additional mark-up, so it seems like your information is outdated. You can find this in the * fine print.

Home trust actually has roadside assistance included in their policy.

The article is very good, but it's outdated. Could you please update? For example, Rogers now pays only for USD transactions, not other currencies; scotiabank gives card for free for ultimate account holders, but they require some weird requirements recently because they fail most applications.

Also, TD first class is comparable to mentioned cards with up to 4.5 % on Expedia and 0 fee for account holders.

Thanks in advance

You're right, Maxim. This post is overdue an update. I'll have to get to it at some point. It's just so boring to research. But the info you provided is a good start. (Maybe you can do the update!)

Thanks again

Great article. I am building my credit right now and am going to work towards a HSBC World M/C.

Right now I have Capital One Secured and Plastk Secured Visa. either one is a good card.

Thanks, Michael. It looks like the Capital One Secured and Plastk Secured don't have zero FX fees. But they seem like solid bets for building credit. Especially the Capital One card, which offers some travel benefits (though not travel medical). Thanks for sharing.

Thanks for your honest reviews -very lacking on blogs lately. FYI, nothing but problems with Home Trust. Very unreliable. Card is constantly declined when trying to use it and HT doesn't bother to reach out by text or phone or email to let you know they blocked it and want to authenticate you. Customer service rarely available and HT outsources to script-reading agents who tell you to call back when HT is working (????) which is usually 3 days later if you are unlucky enough to run into a problem Friday morning. Declined 5 times in less than 3 months, and although escalated the issue, no improvement. As a result, can't trust the card and will be leaving it behind on my next overseas trip. Would never recommend, no confidence at all. Will have to check out the Scotiabank or HSBC, thanks for the input!

Thanks, Anna. Sorry to hear about your troubles with the Home Trust card, but glad that you're sharing them to help others with their decision. Here's hoping whatever card you decide on works out better on your next trip.